MetLife Or Delta Dental: A Comprehensive Guide To Choosing The Best Dental Insurance Provider

When it comes to choosing dental insurance, two of the most prominent names in the industry are MetLife and Delta Dental. Both companies offer a wide range of plans designed to meet the unique needs of individuals and families. However, understanding the differences between these two providers is crucial to making an informed decision.

With the increasing importance of oral health, having reliable dental insurance coverage has become more critical than ever. Whether you're a first-time buyer or looking to switch providers, knowing the strengths and weaknesses of MetLife and Delta Dental will help you make the best choice for your needs.

In this article, we will break down the key features of both MetLife and Delta Dental, including their coverage options, pricing, network availability, and customer service. By the end of this guide, you'll have all the information you need to decide which provider aligns best with your dental care requirements.

Read also:George Memmoli The Visionary Entrepreneur Shaping The Future

Table of Contents

- Overview of MetLife and Delta Dental

- Coverage Options: MetLife vs Delta Dental

- Pricing and Plan Options

- Dental Network Access

- Customer Support and Service

- Claim Process Efficiency

- Additional Benefits and Perks

- Statistical Analysis of User Satisfaction

- Expert Reviews and Recommendations

- Conclusion: Which Provider is Right for You?

Overview of MetLife and Delta Dental

MetLife and Delta Dental are two of the largest dental insurance providers in the United States, each with its own unique approach to delivering quality dental coverage. Understanding the history, mission, and values of these companies can provide valuable insight into what sets them apart.

MetLife: A Leader in Comprehensive Insurance Solutions

MetLife, founded in 1868, is one of the oldest and most respected insurance companies in the world. Known for its diverse range of insurance products, MetLife offers dental insurance as part of its comprehensive benefits package. With a focus on affordability and flexibility, MetLife provides various dental plans tailored to meet individual and group needs.

Delta Dental: Specializing in Dental Care

Delta Dental, established in 1955, is the largest provider of dental benefits in the United States. The company specializes exclusively in dental insurance, allowing it to offer highly specialized plans and services. Delta Dental prides itself on its extensive network of dentists and commitment to improving oral health for all.

Coverage Options: MetLife vs Delta Dental

One of the most important factors to consider when choosing dental insurance is the coverage options available. Both MetLife and Delta Dental offer a variety of plans, but the specifics of their coverage can differ significantly.

MetLife Dental Coverage

MetLife provides three main types of dental plans:

- Preferred Provider Organization (PPO): Offers flexibility in choosing dentists within the MetLife network.

- Health Maintenance Organization (HMO): Requires members to select a primary care dentist from the network.

- Dental Indemnity: Allows members to visit any dentist, but with higher out-of-pocket costs.

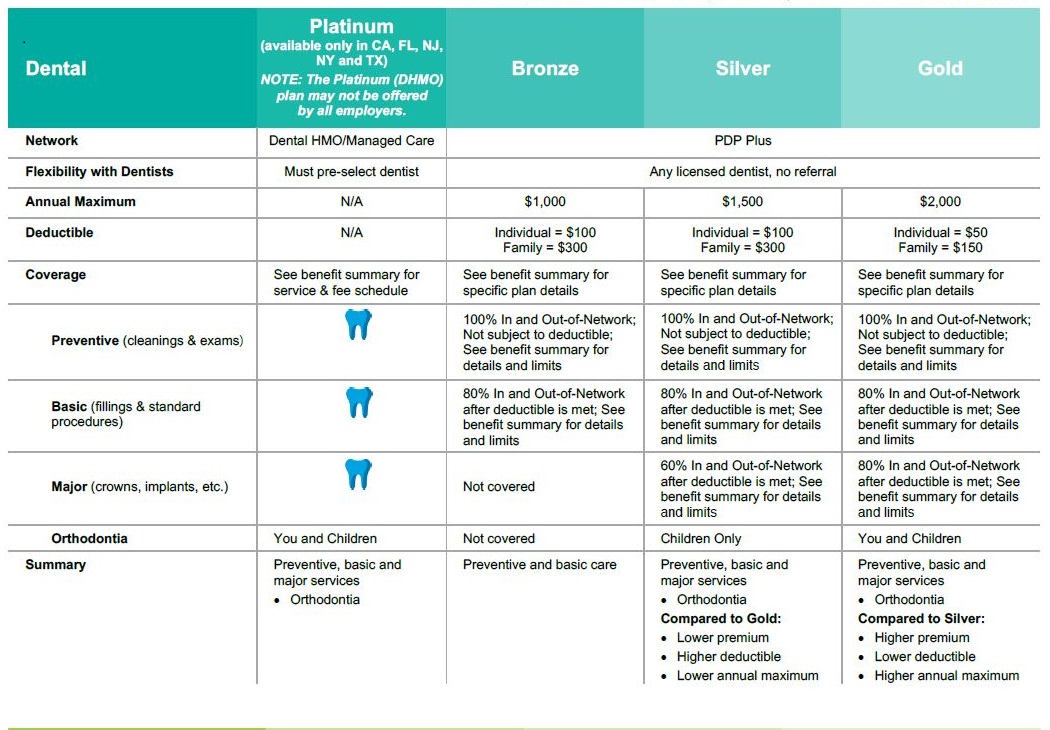

Delta Dental Coverage

Delta Dental offers a similar range of plans, with some variations:

Read also:What Does Shane Gillis Do Exploring The Multifaceted Career Of A Rising Star

- PPO Plans: Provide access to a vast network of dentists across the country.

- Premier Plans: Offer enhanced benefits and lower out-of-pocket costs for in-network services.

- Traditional Plans: Allow members to choose any dentist, with potential higher costs outside the network.

Pricing and Plan Options

Cost is another critical factor when evaluating dental insurance providers. Both MetLife and Delta Dental offer competitive pricing, but the actual cost can vary depending on the plan, location, and individual needs.

MetLife Pricing

MetLife's pricing structure is designed to be transparent and affordable. On average, individual plans start at $20-$50 per month, while group plans can be even more cost-effective. However, the exact price will depend on factors such as age, location, and the level of coverage selected.

Delta Dental Pricing

Delta Dental's pricing is competitive, with individual plans ranging from $25-$60 per month. Group plans are also available at discounted rates. Delta Dental's extensive network and high member satisfaction often justify the slightly higher costs associated with some of its plans.

Dental Network Access

Access to a robust network of dentists is essential for ensuring convenience and quality care. Both MetLife and Delta Dental boast extensive networks, but the size and scope of these networks differ.

MetLife Network

MetLife's dental network includes over 100,000 participating dentists nationwide. This wide network ensures that members have access to quality dental care no matter where they live or travel. Additionally, MetLife's partnership with other insurance providers expands its network even further.

Delta Dental Network

Delta Dental's network is the largest in the country, with over 150,000 participating dentists. This extensive network provides members with unparalleled access to dental care services. Delta Dental's focus on dental care allows it to maintain strong relationships with dentists, ensuring high-quality service for its members.

Customer Support and Service

Exceptional customer service is a key factor in choosing the right dental insurance provider. Both MetLife and Delta Dental are known for their commitment to customer satisfaction.

MetLife Customer Support

MetLife offers 24/7 customer support through its website, phone, and mobile app. Members can easily manage their accounts, view claims status, and access important resources. MetLife's customer service team is highly trained and dedicated to resolving any issues promptly.

Delta Dental Customer Support

Delta Dental provides comprehensive customer support through multiple channels, including online, phone, and in-person assistance. The company's user-friendly website and mobile app make it easy for members to access their account information and find participating dentists. Delta Dental's focus on customer satisfaction has earned it high ratings from its members.

Claim Process Efficiency

A smooth and efficient claim process is essential for ensuring timely payment and minimizing out-of-pocket expenses. Both MetLife and Delta Dental have streamlined their claim processes to improve member satisfaction.

MetLife Claim Process

MetLife's claim process is designed to be quick and hassle-free. Members can submit claims online, via mail, or through the mobile app. MetLife aims to process claims within 30 days, with many being resolved much faster.

Delta Dental Claim Process

Delta Dental's claim process is similarly efficient, with most claims being processed within 15-30 days. Members can submit claims electronically, via mail, or through the Delta Dental mobile app. The company's commitment to transparency ensures that members are kept informed throughout the process.

Additional Benefits and Perks

Both MetLife and Delta Dental offer additional benefits and perks to enhance the value of their dental insurance plans.

MetLife Additional Benefits

MetLife provides several additional benefits, including:

- Discounts on vision and hearing services

- Access to wellness programs and resources

- Flexible spending account (FSA) integration

Delta Dental Additional Benefits

Delta Dental offers a range of additional benefits, such as:

- Specialized programs for children and seniors

- Access to oral health education resources

- Partnerships with leading dental product manufacturers

Statistical Analysis of User Satisfaction

Data and statistics can provide valuable insights into the performance of MetLife and Delta Dental. According to recent surveys:

- MetLife has an average customer satisfaction rating of 4.3 out of 5.

- Delta Dental boasts an impressive satisfaction rating of 4.6 out of 5.

These ratings reflect the high level of service and reliability offered by both companies.

Expert Reviews and Recommendations

Industry experts and analysts have weighed in on the strengths and weaknesses of MetLife and Delta Dental. According to a report by J.D. Power, Delta Dental ranks highly in customer satisfaction due to its extensive network and exceptional service. Meanwhile, MetLife is praised for its diverse range of insurance products and competitive pricing.

Conclusion: Which Provider is Right for You?

Choosing between MetLife and Delta Dental ultimately depends on your specific needs and preferences. If you value a wide range of insurance products and competitive pricing, MetLife may be the better choice. On the other hand, if you prioritize access to a large network of dentists and specialized dental care, Delta Dental could be the ideal option.

We encourage you to take the time to evaluate your options carefully and consider reaching out to both providers for more information. Share your thoughts and experiences in the comments below, and don't forget to explore our other articles for more insights into dental insurance and related topics.