Chase Mortgage Preapproval: Your Comprehensive Guide To Securing Your Dream Home

Securing a mortgage preapproval is a crucial step in the home-buying journey, especially when working with reputable institutions like Chase. Understanding the intricacies of Chase mortgage preapproval can significantly enhance your chances of obtaining a competitive loan and finding the perfect property. Whether you're a first-time buyer or an experienced homeowner, this guide will provide you with the essential information you need to navigate this process successfully.

Mortgage preapproval is more than just a formality; it's a validation of your financial readiness to purchase a home. By obtaining a Chase mortgage preapproval, you demonstrate to sellers and real estate agents that you are a serious buyer who has undergone a thorough financial evaluation. This not only strengthens your bargaining position but also expedites the home-buying process.

In this article, we will delve into the nuances of Chase mortgage preapproval, exploring everything from the application process to the factors that influence approval. Additionally, we will discuss the benefits, requirements, and common pitfalls to avoid. By the end of this guide, you'll be well-equipped to approach your home-buying journey with confidence.

Read also:Unveiling The Shocking Truth Scandal Planet That Shook The World

Table of Contents

- Understanding Chase Mortgage Preapproval

- Benefits of Chase Mortgage Preapproval

- Application Process

- Requirements for Chase Mortgage Preapproval

- Factors Influencing Approval

- Common Pitfalls to Avoid

- Tips for a Successful Application

- Comparison with Other Lenders

- FAQs About Chase Mortgage Preapproval

- Conclusion

Understanding Chase Mortgage Preapproval

What is Mortgage Preapproval?

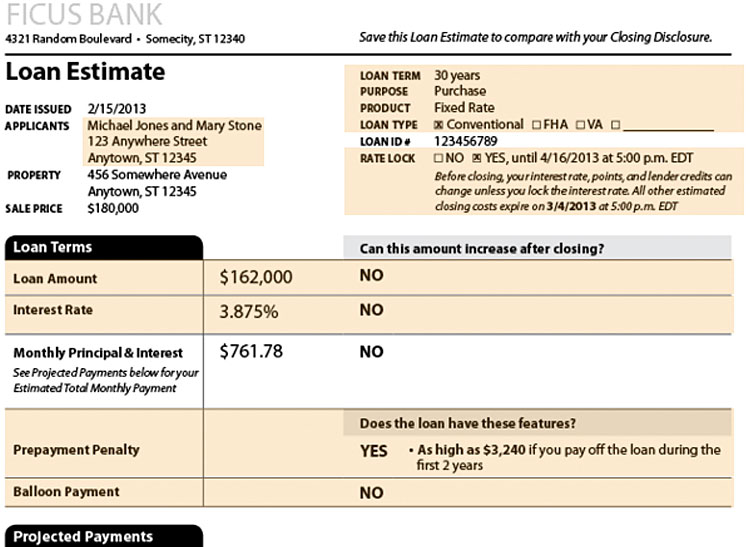

Mortgage preapproval is a formal evaluation of your financial situation by a lender to determine how much you can borrow for a home purchase. Unlike a prequalification, which is an informal estimate, a preapproval involves a detailed review of your income, credit score, debt-to-income ratio, and other financial documents. Chase mortgage preapproval provides a conditional commitment from the bank, giving you a clear idea of your budget and strengthening your negotiating power with sellers.

Why Choose Chase for Mortgage Preapproval?

Chase, one of the largest financial institutions in the United States, offers a robust mortgage preapproval program designed to cater to diverse homebuyers. With competitive interest rates, flexible loan options, and a streamlined application process, Chase stands out as a preferred choice for many buyers. Additionally, Chase's extensive network of branches and online services ensures convenience and accessibility throughout the preapproval process.

Benefits of Chase Mortgage Preapproval

Securing a Chase mortgage preapproval comes with numerous advantages that can make your home-buying journey smoother and more successful. Below are some of the key benefits:

- Clear Budgeting: Knowing your borrowing limit upfront helps you focus on properties within your price range.

- Competitive Edge: Sellers are more likely to consider offers from preapproved buyers, as it demonstrates financial reliability.

- Streamlined Process: Preapproval speeds up the mortgage approval process once you find a property, reducing delays and complications.

- Loan Options: Chase offers various mortgage products, including fixed-rate and adjustable-rate loans, to suit different financial needs.

Application Process

Steps to Apply for Chase Mortgage Preapproval

The application process for Chase mortgage preapproval is straightforward and can be completed either online or in person. Here's a step-by-step guide:

- Gather Necessary Documents: Collect your income statements, tax returns, bank statements, and identification documents.

- Complete the Application: Fill out the preapproval application form on Chase's website or visit a local branch.

- Submit for Review: Once submitted, Chase's underwriting team will review your application and verify your financial information.

- Receive Preapproval Letter: If approved, you will receive a preapproval letter detailing your borrowing limit and loan terms.

Requirements for Chase Mortgage Preapproval

Financial Documentation

To qualify for Chase mortgage preapproval, you must provide certain financial documents that demonstrate your ability to repay the loan. These typically include:

Read also:Mz Dani The Rising Star In The Music Industry

- Past two years of W-2 forms or 1099s for self-employed individuals

- Recent pay stubs covering the last 30 days

- Tax returns from the previous two years

- Bank and investment account statements for the last two months

- Proof of assets, such as retirement accounts or property ownership

Credit Score Requirements

Chase typically requires a minimum credit score of 620 for conventional loans, though higher scores may qualify for better terms. Maintaining a strong credit history is essential for securing favorable interest rates and loan conditions.

Factors Influencing Approval

Credit History and Score

Your credit history plays a pivotal role in the preapproval process. Lenders like Chase assess your creditworthiness based on factors such as payment history, credit utilization, and the length of your credit history. A higher credit score increases your chances of approval and access to better loan terms.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another critical factor. Chase generally prefers a DTI ratio of 43% or lower, ensuring that your monthly debts, including the proposed mortgage, do not exceed 43% of your gross monthly income. Lowering your DTI can improve your preapproval prospects.

Common Pitfalls to Avoid

While pursuing Chase mortgage preapproval, it's important to avoid common mistakes that could jeopardize your application. Below are some pitfalls to steer clear of:

- Opening New Credit Accounts: Avoid applying for new credit cards or loans, as this can negatively impact your credit score.

- Changing Jobs: Staying in the same job or industry during the preapproval process demonstrates stability and reliability.

- Missing Payments: Ensure all your bills and debts are paid on time to maintain a strong financial profile.

Tips for a Successful Application

Boost Your Credit Score

Improving your credit score before applying for Chase mortgage preapproval can enhance your chances of approval. Pay down existing debts, dispute inaccuracies on your credit report, and avoid unnecessary credit inquiries.

Save for a Down Payment

A larger down payment can reduce the loan amount and improve your loan-to-value ratio, making you a more attractive candidate for Chase's preapproval program.

Comparison with Other Lenders

Chase vs. Other Mortgage Lenders

While Chase offers competitive mortgage preapproval options, it's worth comparing their offerings with other lenders. Key considerations include interest rates, loan terms, customer service, and additional fees. Researching multiple lenders can help you secure the best possible deal for your home purchase.

FAQs About Chase Mortgage Preapproval

How Long Does Chase Mortgage Preapproval Take?

The preapproval process typically takes a few days to a couple of weeks, depending on the complexity of your financial situation and the speed of document submission.

Can I Apply for Chase Mortgage Preapproval Online?

Yes, Chase offers an online application portal that allows you to apply for mortgage preapproval from the comfort of your home. Simply gather your financial documents and follow the prompts on their website.

Conclusion

Chase mortgage preapproval is a vital step in the home-buying process that can set you apart from other buyers and give you a competitive edge in the market. By understanding the requirements, following best practices, and avoiding common mistakes, you can successfully secure preapproval and take a significant step toward owning your dream home.

We encourage you to share this article with others who may find it helpful and leave your thoughts or questions in the comments section below. For more informative content on real estate and finance, explore our other articles on the website.