TIAA CD: A Comprehensive Guide To Understanding TIAA Certificate Of Deposit

Are you exploring investment options and wondering if TIAA Certificate of Deposit (CD) is the right choice for you? TIAA CD has become a popular option among investors seeking stability and predictable returns. This article delves into the intricacies of TIAA CDs, helping you understand their benefits, risks, and how they fit into your financial strategy.

TIAA CD offers a secure and reliable way to grow your wealth over time. It is especially appealing to individuals who prioritize safety and consistency in their investments. Whether you're a beginner or an experienced investor, understanding TIAA CDs can enhance your financial portfolio.

In this guide, we will explore the features, advantages, and considerations of TIAA CDs. By the end of this article, you'll have a clear understanding of whether TIAA CD aligns with your financial goals. Let's dive in!

Read also:Rihannas Real Name And Age Unveiling The Iconic Persona Behind The Pop Queen

Table of Contents

- Introduction to TIAA CD

- Benefits of TIAA CD

- How TIAA CD Works

- Types of TIAA CDs

- Investment Considerations

- Risks Associated with TIAA CD

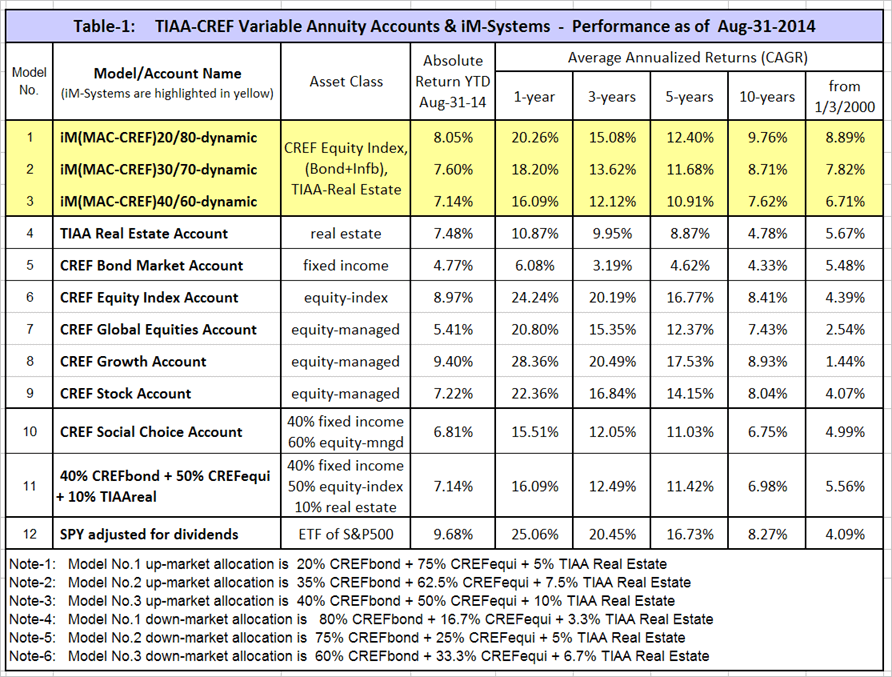

- Comparison with Other Investment Options

- Eligibility and Requirements

- Opening a TIAA CD Account

- Conclusion

Introduction to TIAA CD

TIAA Certificate of Deposit, commonly referred to as TIAA CD, is a financial product offered by TIAA (Teachers Insurance and Annuity Association). It is designed to provide investors with a fixed interest rate over a specified period, making it an attractive option for those seeking low-risk investments.

TIAA has been a trusted financial institution since its establishment in 1918, primarily serving educators, researchers, and other professionals in the academic and nonprofit sectors. Over the years, it has expanded its services to include a wide range of investment products, including TIAA CDs.

Investors who choose TIAA CDs benefit from the institution's reputation for stability and reliability. This makes TIAA CD an excellent choice for individuals looking to secure their financial future without exposing themselves to excessive risk.

Benefits of TIAA CD

TIAA CDs offer several advantages that make them a compelling investment option. Below are some of the key benefits:

1. Fixed Interest Rates

TIAA CDs provide investors with a guaranteed interest rate for the duration of the investment. This predictability allows investors to plan their finances with confidence.

2. Safety and Security

One of the most significant advantages of TIAA CDs is their safety. Backed by a reputable financial institution, TIAA CDs are a secure way to grow your money without worrying about market fluctuations.

Read also:Lynn Louisa Woodruff A Comprehensive Exploration Of Her Life Career And Achievements

3. Diversification

Including TIAA CDs in your investment portfolio can help diversify your assets. This diversification reduces overall risk and enhances the stability of your financial portfolio.

These benefits make TIAA CDs an ideal choice for conservative investors who prioritize stability and reliability.

How TIAA CD Works

TIAA CDs operate similarly to traditional certificates of deposit. Here's how they work:

- Investors deposit a specific amount of money into a TIAA CD account.

- The account earns a fixed interest rate over a predetermined period, known as the term.

- At the end of the term, investors receive their initial deposit plus the accrued interest.

TIAA CDs are available in various terms, ranging from a few months to several years. This flexibility allows investors to choose a term that aligns with their financial goals.

Additionally, TIAA CDs are FDIC-insured up to $250,000, providing an extra layer of security for your investment.

Types of TIAA CDs

TIAA offers different types of CDs to cater to diverse investor needs. Below are some of the most common types:

1. Traditional TIAA CDs

These CDs offer a fixed interest rate for the duration of the term. They are ideal for investors seeking predictable returns.

2. Variable Rate TIAA CDs

Variable rate TIAA CDs have interest rates that adjust periodically based on market conditions. This type of CD can be beneficial if interest rates are expected to rise.

3. Callable TIAA CDs

Callable TIAA CDs allow the issuer to redeem the CD before the maturity date under specific conditions. Investors should carefully consider the risks associated with callable CDs.

Understanding the different types of TIAA CDs can help you choose the one that best fits your investment strategy.

Investment Considerations

Before investing in TIAA CDs, there are several factors to consider:

1. Investment Goals

Assess your financial goals and determine how TIAA CDs fit into your overall investment strategy. Are you looking for short-term or long-term growth?

2. Liquidity Needs

Consider your liquidity requirements. TIAA CDs typically have early withdrawal penalties, so ensure you have access to other funds if needed.

3. Interest Rates

Compare TIAA CD interest rates with other investment options to ensure you're getting the best return for your money.

By carefully evaluating these considerations, you can make an informed decision about investing in TIAA CDs.

Risks Associated with TIAA CD

While TIAA CDs are generally considered low-risk investments, they do come with some risks:

1. Inflation Risk

The fixed interest rate of TIAA CDs may not keep up with inflation, potentially reducing the purchasing power of your investment over time.

2. Opportunity Cost

Investing in TIAA CDs may result in missed opportunities to earn higher returns through other investment options.

3. Early Withdrawal Penalties

Withdrawing funds from a TIAA CD before maturity can result in significant penalties, impacting your overall returns.

Understanding these risks can help you mitigate them and make the most of your TIAA CD investment.

Comparison with Other Investment Options

TIAA CDs can be compared to other investment options such as savings accounts, bonds, and stocks. Here's a brief comparison:

1. Savings Accounts

While savings accounts offer more liquidity, they typically have lower interest rates compared to TIAA CDs.

2. Bonds

Bonds can offer higher returns than TIAA CDs but often come with greater risk and volatility.

3. Stocks

Stocks have the potential for high returns but are subject to significant market fluctuations, making them a riskier option.

TIAA CDs strike a balance between risk and reward, making them an attractive option for many investors.

Eligibility and Requirements

To invest in TIAA CDs, you must meet certain eligibility criteria:

- Be a member of TIAA's eligible groups, such as educators or nonprofit professionals.

- Have a minimum initial deposit, which varies depending on the CD type.

- Complete the necessary application and documentation process.

These requirements ensure that TIAA CDs are accessible to the right audience while maintaining the institution's standards.

Opening a TIAA CD Account

Opening a TIAA CD account is a straightforward process. Follow these steps:

- Contact TIAA to discuss your investment goals and determine the best CD option for you.

- Complete the application form and provide any required documentation.

- Deposit the initial funds into your TIAA CD account.

TIAA's customer service team is available to guide you through the process and answer any questions you may have.

Conclusion

TIAA CDs offer a secure and predictable way to grow your wealth over time. With their fixed interest rates, safety, and flexibility, they are an excellent option for conservative investors seeking stability. However, it's essential to consider the risks and investment considerations before committing to a TIAA CD.

We encourage you to explore TIAA CDs further and assess how they align with your financial goals. Feel free to leave a comment or share this article with others who may find it helpful. For more insights into financial planning and investment options, explore our other articles on our website.

References:

1. TIAA Official Website

2. FDIC Insurance Information

3. Investment Research Reports