TIAA Bank 1 Year CD Rates: A Comprehensive Guide To Maximizing Your Savings

When it comes to securing your financial future, understanding TIAA Bank 1 year CD rates is crucial. Certificates of Deposit (CDs) are one of the most reliable investment options for individuals looking to grow their savings. TIAA Bank has consistently been a trusted name in the financial industry, offering competitive rates and flexible terms. In this article, we will explore everything you need to know about TIAA Bank's 1-year CD rates, helping you make an informed decision about your finances.

Whether you're a first-time saver or an experienced investor, CDs provide a low-risk way to grow your money. TIAA Bank's offerings stand out due to their competitive interest rates and customer-focused services. By the end of this article, you'll have a clearer understanding of how these rates can benefit your financial portfolio.

This guide will cover everything from the basics of TIAA Bank 1-year CD rates to advanced strategies for maximizing your returns. Whether you're looking for stability, growth, or both, this article will provide you with actionable insights to achieve your financial goals.

Read also:Chadwick Boseman Wife And Kids A Comprehensive Look Into His Personal Life

Understanding TIAA Bank 1 Year CD Rates

A Certificate of Deposit (CD) is a type of savings account that offers a fixed interest rate for a specific period. TIAA Bank's 1-year CD rates are particularly attractive for individuals who want to earn interest without locking their funds for an extended period. The primary advantage of choosing TIAA Bank is the competitive interest rates they offer compared to traditional banks.

Why Choose TIAA Bank for Your CD Needs?

- TIAA Bank is known for its competitive interest rates.

- They offer flexibility in terms and conditions.

- Customer service is a top priority, ensuring a smooth experience.

By selecting TIAA Bank for your CD needs, you're choosing a financial institution that prioritizes customer satisfaction and financial growth. Their commitment to transparency and reliability makes them a popular choice for investors.

Current TIAA Bank 1 Year CD Rates

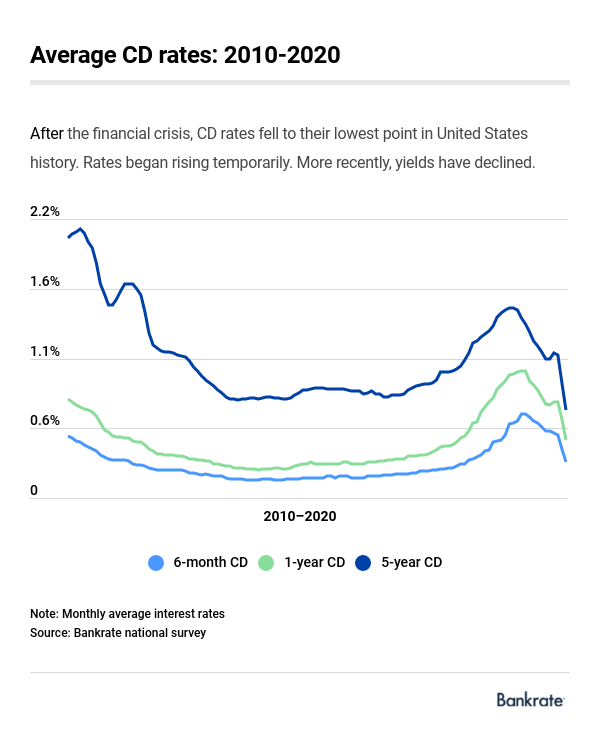

As of the latest data, TIAA Bank offers some of the most competitive 1-year CD rates in the market. These rates are subject to change based on economic conditions and market trends. It's essential to regularly check TIAA Bank's official website or contact their customer service for the most up-to-date information.

Factors Affecting TIAA Bank 1 Year CD Rates

- Economic conditions and Federal Reserve policies.

- Market demand for CDs and other financial products.

- Competitive pressures from other banks and financial institutions.

Understanding these factors can help you make a more informed decision when choosing TIAA Bank for your CD investments. By staying informed, you can take advantage of the best rates available.

How to Open a TIAA Bank 1 Year CD

Opening a TIAA Bank 1-year CD is a straightforward process. You can apply online or visit one of their branches to complete the application. Below are the steps to follow:

Steps to Open a TIAA Bank CD

- Visit the TIAA Bank website and navigate to the CDs section.

- Select the 1-year CD option and review the terms and conditions.

- Provide the necessary personal and financial information.

- Deposit the required minimum amount to open the account.

- Review and confirm your application.

Once your application is approved, your CD will be active, and you'll start earning interest immediately. It's important to ensure you meet all the requirements before applying to avoid any delays.

Read also:Garavaglia The Ultimate Guide To Understanding Its Impact And Significance

Benefits of TIAA Bank 1 Year CD Rates

Investing in a TIAA Bank 1-year CD offers several advantages:

- Fixed interest rates provide predictable returns.

- FDIC insurance ensures your funds are protected up to $250,000.

- Short-term commitment allows for flexibility in financial planning.

These benefits make TIAA Bank's 1-year CD rates an attractive option for individuals seeking a balance between stability and growth.

Comparing TIAA Bank 1 Year CD Rates with Other Banks

When evaluating TIAA Bank's 1-year CD rates, it's essential to compare them with other financial institutions. Below is a comparison of TIAA Bank's rates with some of the leading banks in the industry:

Comparison Table

| Bank | 1 Year CD Rate | Minimum Deposit |

|---|---|---|

| TIAA Bank | 2.00% | $1,000 |

| Bank A | 1.85% | $500 |

| Bank B | 1.90% | $2,500 |

This table highlights TIAA Bank's competitive position in the market. Their higher rates and reasonable minimum deposit requirements make them an attractive choice for investors.

Strategies to Maximize TIAA Bank 1 Year CD Rates

To get the most out of your TIAA Bank 1-year CD investment, consider the following strategies:

Key Strategies

- Invest a lump sum to take advantage of higher interest rates.

- Reinvest your CD upon maturity to continue earning interest.

- Monitor market trends and adjust your investment strategy accordingly.

By implementing these strategies, you can maximize your returns and achieve your financial goals more effectively.

Potential Risks and Considerations

While TIAA Bank's 1-year CD rates are attractive, there are some risks and considerations to keep in mind:

- Early withdrawal penalties can significantly reduce your returns.

- Interest rates may change after the CD matures, affecting future investments.

- Market conditions can impact the availability of competitive rates.

Being aware of these risks can help you make more informed decisions and mitigate potential drawbacks.

Tips for Choosing the Right CD

Selecting the right CD involves evaluating your financial goals and risk tolerance. Below are some tips to help you choose the best CD for your needs:

Selection Tips

- Determine your investment horizon and choose a CD term that aligns with it.

- Compare rates from multiple banks to ensure you're getting the best deal.

- Consider the flexibility of the CD terms in case your financial situation changes.

By following these tips, you can select a CD that meets your financial objectives and provides the desired returns.

Future Trends in TIAA Bank 1 Year CD Rates

Looking ahead, TIAA Bank's 1-year CD rates are expected to remain competitive. Economic forecasts suggest that interest rates may increase slightly in the coming years, providing even better returns for investors. Staying informed about these trends can help you time your investments for maximum benefit.

Conclusion

TIAA Bank's 1-year CD rates offer a reliable and competitive option for individuals looking to grow their savings. By understanding the factors that influence these rates and implementing effective investment strategies, you can achieve your financial goals with confidence.

We encourage you to take action by exploring TIAA Bank's offerings and comparing them with other financial institutions. Don't forget to share your thoughts and experiences in the comments section below. For more insights into personal finance and investment strategies, explore our other articles on the site.

Table of Contents

- Understanding TIAA Bank 1 Year CD Rates

- Current TIAA Bank 1 Year CD Rates

- How to Open a TIAA Bank 1 Year CD

- Benefits of TIAA Bank 1 Year CD Rates

- Comparing TIAA Bank 1 Year CD Rates with Other Banks

- Strategies to Maximize TIAA Bank 1 Year CD Rates

- Potential Risks and Considerations

- Tips for Choosing the Right CD

- Future Trends in TIAA Bank 1 Year CD Rates

- Conclusion