Maximizing Your MyVanilla Prepaid Balance: A Comprehensive Guide

Managing your MyVanilla prepaid balance effectively can significantly enhance your travel and financial planning. Whether you're a frequent traveler or looking to optimize your spending, understanding how MyVanilla prepaid balance works is essential. This article dives deep into everything you need to know about MyVanilla prepaid balance, including tips, tricks, and expert advice to help you make the most of it.

As more people turn to prepaid cards for convenience and control over their finances, MyVanilla prepaid balance has emerged as a popular choice. This versatile tool allows users to load funds, track expenses, and access global payment networks seamlessly. In this guide, we'll explore how to maximize the benefits of your MyVanilla prepaid balance while ensuring you stay within your budget.

Whether you're using it for personal or business purposes, understanding the ins and outs of MyVanilla prepaid balance is crucial. From loading funds to managing security features, we'll cover all the essential aspects to empower you with the knowledge you need. Let's get started!

Read also:The Ultimate Guide To Understanding Net Framework Applications And Future Trends

Table of Contents

- What is MyVanilla Prepaid Balance?

- Benefits of Using MyVanilla Prepaid Balance

- How to Get a MyVanilla Prepaid Card

- Loading Funds onto Your MyVanilla Prepaid Balance

- Using Your MyVanilla Prepaid Card

- Security Features of MyVanilla Prepaid Balance

- Fees Associated with MyVanilla Prepaid Balance

- Tips for Maximizing Your MyVanilla Prepaid Balance

- Troubleshooting Common Issues

- Conclusion

What is MyVanilla Prepaid Balance?

MyVanilla prepaid balance refers to a reloadable prepaid card that allows users to load and spend funds without the need for a traditional bank account. This card operates on major payment networks such as Visa and Mastercard, making it widely accepted globally. It's an excellent option for individuals who prefer prepaid solutions over credit or debit cards.

One of the key advantages of MyVanilla prepaid balance is its flexibility. Users can load funds in multiple currencies, making it ideal for international travelers. Additionally, the card provides robust security features, ensuring your financial information remains protected.

Key Features of MyVanilla Prepaid Balance

- Reloadable with ease

- Accepted worldwide

- Multiple currency support

- Real-time transaction tracking

Benefits of Using MyVanilla Prepaid Balance

There are numerous advantages to using MyVanilla prepaid balance, making it a popular choice among consumers. Below are some of the key benefits:

- Financial Control: You can only spend what you load onto the card, helping you manage your budget effectively.

- Global Acceptance: With compatibility on major payment networks, your MyVanilla prepaid balance is accepted almost everywhere.

- No Credit Checks: Unlike credit cards, MyVanilla prepaid balance does not require a credit check, making it accessible to more users.

- Security: The card offers advanced security features, including PIN protection and fraud monitoring.

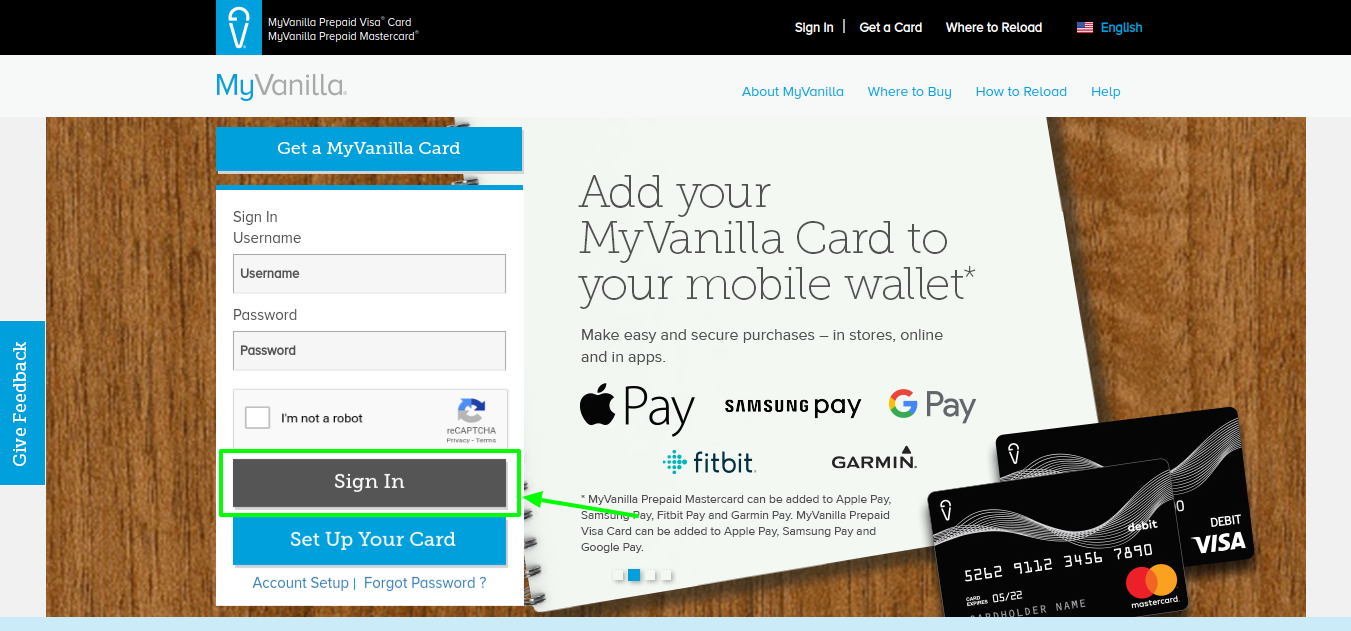

How to Get a MyVanilla Prepaid Card

Acquiring a MyVanilla prepaid card is straightforward. Here's a step-by-step guide:

- Visit the official MyVanilla website or authorized retailer.

- Select the prepaid card that best suits your needs.

- Complete the registration process, which may include providing personal information such as your name, address, and identification.

- Activate your card by following the instructions provided.

Important Documents Needed

When applying for a MyVanilla prepaid card, you'll need to provide certain documents:

- Valid government-issued ID (e.g., passport or driver's license)

- Proof of address (e.g., utility bill or bank statement)

Loading Funds onto Your MyVanilla Prepaid Balance

Loading funds onto your MyVanilla prepaid balance is a simple process. You can do this through various methods:

Read also:Jaina Lee Ortiz The Rising Star In Hollywood

Methods for Loading Funds

- Bank Transfer: Transfer funds directly from your bank account to your MyVanilla prepaid balance.

- Cash Load: Use authorized retail locations to load cash onto your card.

- Mobile App: Many MyVanilla cards come with a mobile app that allows you to load funds easily.

Using Your MyVanilla Prepaid Card

Once your MyVanilla prepaid balance is loaded, you can use it for various transactions:

Common Uses of MyVanilla Prepaid Card

- Shopping online and in-store

- Booking travel arrangements

- Paying bills

- Withdrawing cash from ATMs

Remember to always keep track of your balance to avoid overspending. Most MyVanilla prepaid cards offer real-time transaction alerts via text or email, helping you stay informed.

Security Features of MyVanilla Prepaid Balance

Security is a top priority for MyVanilla prepaid balance users. Here are some of the security features included:

- PIN Protection: Protect your card with a unique PIN for added security.

- Fraud Monitoring: Advanced algorithms monitor your transactions for suspicious activity.

- Card Blocking: If your card is lost or stolen, you can block it immediately through the mobile app or website.

Best Practices for Card Security

To ensure the safety of your MyVanilla prepaid balance, follow these best practices:

- Never share your PIN or account details with anyone.

- Regularly check your transaction history for unauthorized activity.

- Use secure networks when accessing your account online.

Fees Associated with MyVanilla Prepaid Balance

While MyVanilla prepaid balance offers many benefits, it's important to be aware of potential fees:

Common Fees

- Activation Fee: A one-time fee when you first activate your card.

- Monthly Maintenance Fee: Some cards charge a monthly fee unless certain conditions are met.

- ATM Withdrawal Fee: Fees may apply when withdrawing cash from ATMs.

Always review the fee structure before choosing a MyVanilla prepaid card to ensure it aligns with your financial goals.

Tips for Maximizing Your MyVanilla Prepaid Balance

Here are some expert tips to help you make the most of your MyVanilla prepaid balance:

- Set a budget and stick to it to avoid overspending.

- Take advantage of any rewards or cashback programs offered by MyVanilla.

- Regularly review your account statements for any discrepancies.

- Use the mobile app for real-time tracking and management of your funds.

Troubleshooting Common Issues

Encountering issues with your MyVanilla prepaid balance? Here's how to resolve them:

Common Problems and Solutions

- Transaction Declined: Ensure your balance is sufficient and your card is activated.

- Lost or Stolen Card: Block your card immediately and request a replacement.

- Technical Issues: Contact MyVanilla customer support for assistance.

Conclusion

In conclusion, MyVanilla prepaid balance offers a convenient and secure way to manage your finances. By understanding its features, benefits, and potential fees, you can make informed decisions to optimize your use of the card. Whether you're traveling abroad or simply looking for better financial control, MyVanilla prepaid balance is a valuable tool.

We encourage you to share your thoughts and experiences in the comments below. Additionally, feel free to explore other articles on our site for more insights into personal finance and travel tips. Together, let's make the most of our financial tools and achieve our goals!