How To Order Check From Chase: A Comprehensive Guide For Managing Your Finances

Managing your finances effectively is crucial, and understanding how to order check from Chase can be a game-changer for your banking experience. Whether you're a new Chase customer or looking to replenish your check supply, this article will provide you with a step-by-step guide to ensure the process is seamless. In today's digital age, having a reliable method of payment like checks remains essential for various financial transactions.

Ordering checks from Chase is not only convenient but also secure, ensuring that your personal and business needs are met efficiently. With Chase's robust banking services, you can customize your check orders to fit your preferences, whether you need personal checks, business checks, or even duplicate checks. This article will walk you through everything you need to know about ordering checks, from the initial setup to receiving your order.

As part of your financial management strategy, knowing how to order check from Chase can help you stay organized and in control of your money. Whether you're paying bills, managing expenses, or handling large transactions, having access to checks provides flexibility and peace of mind. Let's dive deeper into the process and explore the benefits of ordering checks through Chase.

Read also:Best Scorpion Casino Coins To Buy Your Ultimate Guide To Maximizing Profits

Understanding the Importance of Checks in Modern Banking

While digital payment methods have become increasingly popular, checks remain an essential part of modern banking. They offer a secure and traceable way to transfer funds, making them ideal for various transactions such as paying rent, settling invoices, or gifting money. When you choose to order check from Chase, you're ensuring that you have a reliable payment option that works for both personal and professional needs.

Advantages of Using Checks

- Secure payment method with a record of the transaction

- Versatile for various types of payments, including one-time and large transactions

- Customizable options to suit personal or business requirements

- Accepted widely, even in situations where digital payments are not feasible

Checks provide a tangible form of payment that can be particularly useful when dealing with individuals or businesses that prefer traditional methods. By ordering checks from Chase, you gain access to a service that combines convenience with reliability, ensuring that your financial transactions are handled smoothly.

Step-by-Step Guide: How to Order Check From Chase

1. Log in to Your Chase Online Account

To begin the process of ordering checks, you'll need to log in to your Chase online account. This ensures that your personal information is securely accessed and that your order is linked to your account. If you're not already registered for online banking, you'll need to sign up first by visiting Chase's official website and following the registration steps.

2. Navigate to the "Order Checks" Section

Once logged in, locate the "Order Checks" section within your account dashboard. This section is typically found under the "Account Services" or "Settings" menu. By clicking on this option, you'll be directed to a page where you can customize your check order.

3. Customize Your Check Order

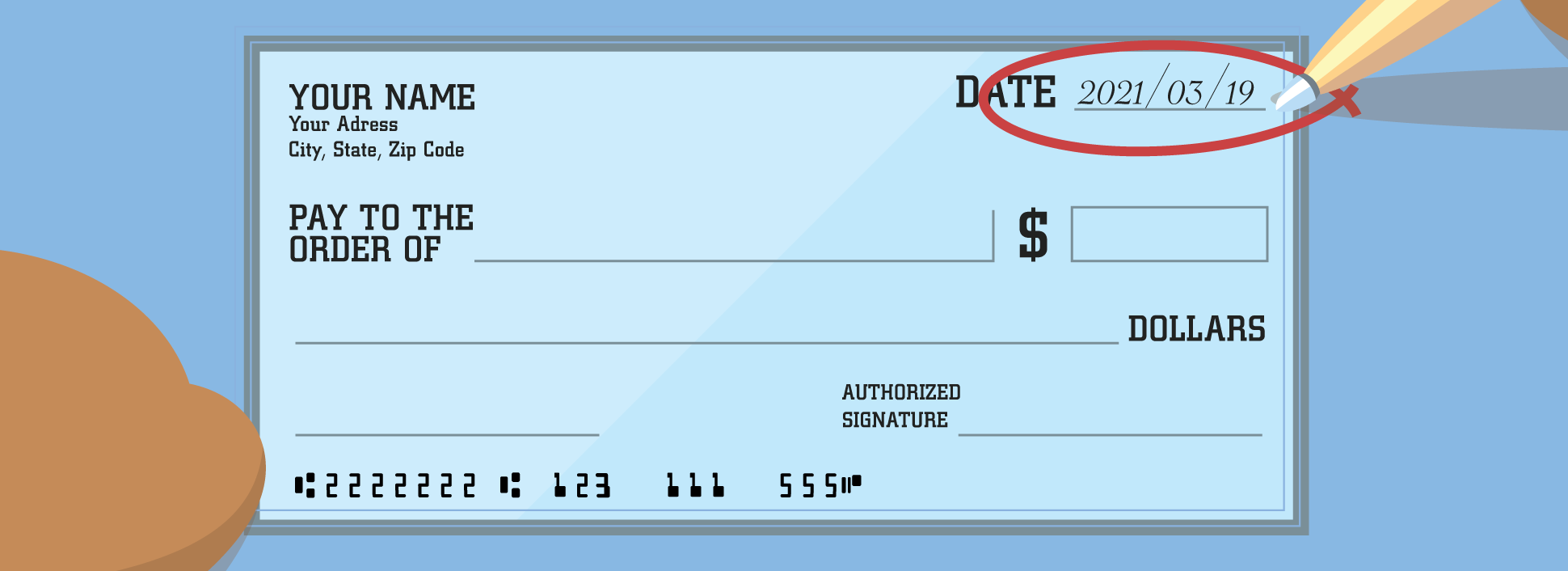

Chase offers a variety of check options, allowing you to choose the design and features that best suit your needs. Whether you prefer personalized checks with your name and address or business checks with your company logo, Chase has options for everyone. You can also select the number of checks you wish to order, ensuring you have enough for your upcoming transactions.

4. Review and Confirm Your Order

Before finalizing your order, take a moment to review all the details, including the type of checks, quantity, and any additional features you've selected. Once you're satisfied with your choices, confirm your order and proceed to the payment section. Chase may offer free check ordering for certain account types, so be sure to check if you qualify for any promotions or discounts.

Read also:Halil Ibrahim Ceyhan Siblings Exploring The Legacy And Family Connections

Factors to Consider When Ordering Checks

When deciding how to order check from Chase, there are several factors to consider to ensure that you make the best choice for your financial needs. Understanding these factors can help you optimize your check order and avoid any potential issues.

1. Check Type

Chase offers different types of checks, including personal checks, business checks, and duplicate checks. Personal checks are ideal for everyday transactions, while business checks are designed for professional use. Duplicate checks provide a carbon copy of each check, which can be useful for record-keeping purposes.

2. Security Features

Security is a top priority when it comes to financial transactions. Chase incorporates advanced security features in their checks, such as watermarks, security threads, and color-shifting ink, to prevent fraud and ensure the authenticity of your checks.

3. Delivery Options

Chase offers various delivery options for your check order, including standard mail and expedited shipping. Depending on your urgency, you can choose the delivery method that best fits your timeline. Standard delivery typically takes 7-10 business days, while expedited shipping can deliver your checks within 2-3 business days.

Common Questions About Ordering Checks from Chase

1. How Long Does It Take to Receive My Checks?

The delivery time for your check order depends on the shipping method you choose. Standard delivery usually takes 7-10 business days, while expedited shipping can deliver your checks within 2-3 business days. It's essential to plan ahead and order checks in advance to avoid any disruptions in your financial transactions.

2. Can I Cancel My Check Order?

Yes, you can cancel your check order if it hasn't been processed yet. To do so, contact Chase customer service and provide them with your order details. If the order has already been processed, cancellation may not be possible, and you may need to wait for the checks to arrive.

3. Are There Any Fees for Ordering Checks?

Chase may offer free check ordering for certain account types, such as premium accounts or as part of promotional offers. For other accounts, there may be a fee associated with ordering checks. Be sure to check the terms and conditions of your account to determine if you qualify for any discounts or free check ordering services.

Tips for Managing Your Checks Effectively

Once you've ordered your checks from Chase, it's important to manage them effectively to ensure that your financial transactions run smoothly. Here are some tips to help you make the most of your checkbook:

- Keep your checks in a secure location to prevent unauthorized access

- Record each check you write in your checkbook register to track your expenses

- Regularly reconcile your checkbook with your bank statements to avoid discrepancies

- Order checks in advance to ensure you always have a supply on hand

By following these tips, you can maintain better control over your finances and ensure that your checks are used responsibly and efficiently.

Security Measures to Protect Your Checks

Protecting your checks is crucial to prevent fraud and unauthorized transactions. Chase implements several security measures to safeguard your checks, but there are also steps you can take to enhance their security:

- Sign your checks immediately upon receiving them

- Store your checks in a locked drawer or safe when not in use

- Report any lost or stolen checks to Chase customer service immediately

- Regularly monitor your account for any suspicious activity

By combining Chase's security features with your own proactive measures, you can significantly reduce the risk of check fraud and protect your financial information.

Benefits of Ordering Checks from Chase

Ordering checks from Chase offers numerous benefits that make it a preferred choice for many customers. Some of these benefits include:

- Customizable check options to suit your personal or business needs

- Advanced security features to protect your checks from fraud

- Convenient online ordering process with easy access to your account

- Reliable delivery options to ensure your checks arrive on time

By choosing to order check from Chase, you gain access to a service that prioritizes your security and convenience, making it easier to manage your finances effectively.

Conclusion and Call to Action

In conclusion, understanding how to order check from Chase is an essential part of managing your finances. By following the step-by-step guide outlined in this article, you can ensure that your check ordering process is smooth and efficient. Chase's commitment to security, customization, and convenience makes it a reliable choice for all your check-related needs.

We invite you to share your thoughts and experiences with ordering checks from Chase in the comments section below. Your feedback can help other readers make informed decisions about their financial management strategies. Additionally, don't forget to explore other articles on our site for more tips and insights on managing your finances effectively.

Table of Contents

- Understanding the Importance of Checks in Modern Banking

- Step-by-Step Guide: How to Order Check From Chase

- Factors to Consider When Ordering Checks

- Common Questions About Ordering Checks from Chase

- Tips for Managing Your Checks Effectively

- Security Measures to Protect Your Checks

- Benefits of Ordering Checks from Chase

- Conclusion and Call to Action