Chase Order Checkbook: A Comprehensive Guide To Managing Your Financial Transactions

Chase Order Checkbook is a crucial aspect of financial management that helps individuals and businesses maintain organized and secure financial transactions. Whether you're dealing with personal finances or managing a business, understanding how to order and manage checkbooks effectively can streamline your financial processes. This guide provides in-depth insights into the topic, offering practical tips and expert advice to help you navigate the world of checkbook ordering.

Managing finances can be overwhelming, especially when dealing with multiple transactions. Having a reliable system in place, such as ordering a checkbook from Chase, ensures that all your payments are recorded accurately. This not only enhances transparency but also helps prevent fraud and errors.

In this article, we will explore the importance of Chase checkbooks, how to order them, and best practices for maintaining your financial health. Whether you're new to banking or a seasoned professional, this guide will provide valuable insights to improve your financial management skills.

Read also:Does Bianca Censori Have Implants Unveiling The Truth Behind Her Stunning Looks

Table of Contents

- Biography

- Understanding Checkbooks

- Benefits of Chase Checkbooks

- How to Order Checkbooks

- Online Order Process

- Security Features

- Costs and Fees

- Tips for Managing Checkbooks

- Common Issues and Solutions

- Future Trends in Checkbook Management

Biography

Chase Bank, part of JPMorgan Chase & Co., is one of the largest financial institutions in the United States. Known for its extensive network of branches and ATMs, Chase offers a wide range of banking services, including checking accounts, savings accounts, loans, and investment products. The bank's commitment to customer satisfaction and innovation has made it a trusted name in the financial industry.

Below is a table summarizing key information about Chase Bank:

| Full Name | JPMorgan Chase & Co. |

|---|---|

| Foundation Year | 1799 |

| Headquarters | New York City, USA |

| Services Offered | Checking accounts, savings accounts, loans, investments, credit cards |

| Website | www.chase.com |

Understanding Checkbooks

A checkbook is a booklet containing pre-printed checks that are used to make payments or transfer funds from one account to another. It serves as a formal method of payment and is widely accepted by businesses and individuals. Understanding how checkbooks work is essential for anyone managing their finances.

History of Checkbooks

The use of checks dates back to the 13th century when merchants in Italy began using written instructions to transfer funds. Over time, the system evolved, and by the 19th century, checkbooks became a standard tool for banking transactions. Today, they remain an important part of financial management, especially for those who prefer paper-based transactions.

Benefits of Chase Checkbooks

Chase checkbooks offer several advantages that make them a popular choice among customers. Below are some key benefits:

- Security: Chase incorporates advanced security features to protect your checks from fraud.

- Convenience: Ordering checkbooks through Chase is simple and can be done online or in person.

- Customization: Customers can personalize their checks with unique designs and information.

- Reliability: Chase ensures that checkbooks are delivered promptly and accurately.

How to Order Checkbooks

Ordering a checkbook from Chase is a straightforward process. Whether you're a new customer or an existing account holder, the steps remain largely the same. Here's a detailed guide:

Read also:Methstream Labs Revolutionizing The Future Of Methamphetamine Detection

Steps to Order Checkbooks

1. Log in to your Chase online account or visit a local branch.

2. Navigate to the "Order Checks" section and select the type of checkbook you need.

3. Customize your checkbook with your preferred design and layout.

4. Review your order and confirm the details before submitting.

Online Order Process

With the rise of digital banking, ordering checkbooks online has become more convenient than ever. Chase offers a user-friendly platform that allows customers to place their orders with ease. Here are some tips for a seamless online experience:

- Ensure your account information is up-to-date.

- Choose a secure password and enable two-factor authentication for added protection.

- Keep track of your order status through the Chase app or website.

Security Features

Security is a top priority for Chase, and their checkbooks are equipped with various features to safeguard your financial information. These include:

- Watermark technology to prevent forgery.

- Microprint lines that are difficult to replicate.

- Security ink that changes color when viewed from different angles.

Costs and Fees

While Chase offers competitive pricing for its checkbooks, it's important to be aware of any associated costs. Typically, the price depends on the type of checkbook and the quantity ordered. Additionally, some accounts may come with free checkbook offers as part of their benefits package.

Factors Affecting Costs

1. Account type: Premium accounts often receive discounted rates or free checkbooks.

2. Quantity: Ordering in bulk may result in lower per-unit costs.

3. Customization: Personalized designs and layouts may incur additional charges.

Tips for Managing Checkbooks

Effectively managing your checkbook can help you maintain better control over your finances. Here are some practical tips:

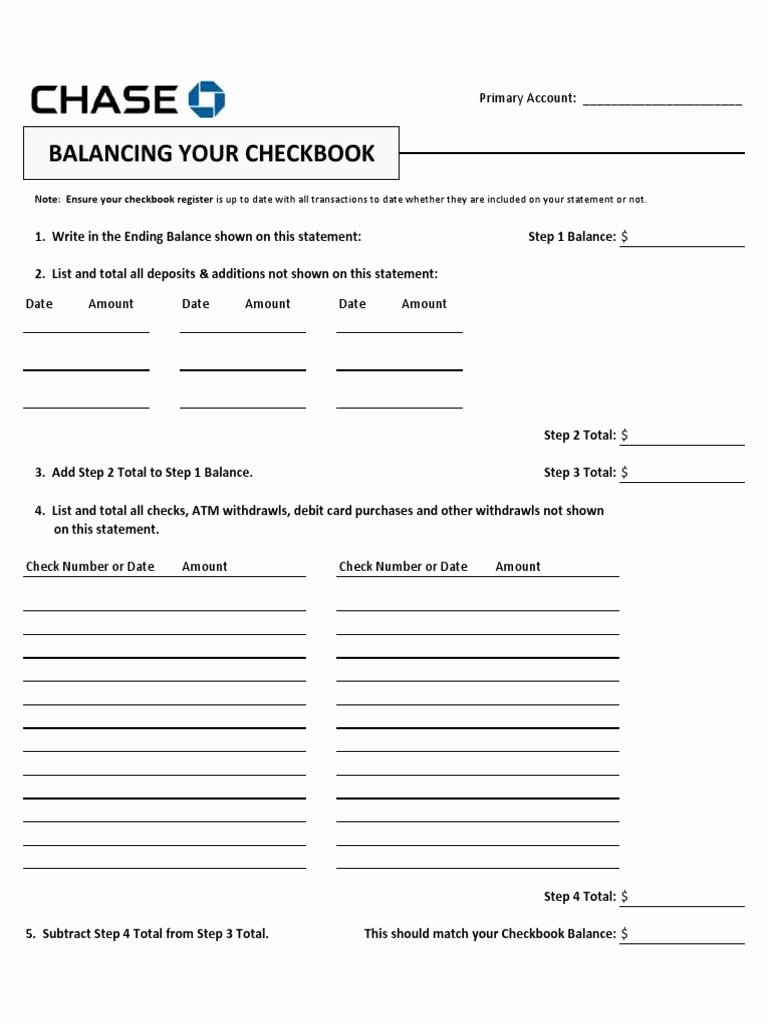

- Keep a record of all checks issued and their corresponding amounts.

- Reconcile your checkbook with your bank statement regularly.

- Report any discrepancies or unauthorized transactions immediately.

Common Issues and Solutions

Despite their reliability, checkbooks can sometimes present challenges. Below are some common issues and their solutions:

- Lost or Stolen Checkbooks: Contact Chase immediately to report the loss and request a replacement.

- Insufficient Funds: Monitor your account balance regularly to avoid bounced checks.

- Delivery Delays: Check the status of your order online or contact customer service for assistance.

Future Trends in Checkbook Management

As technology continues to advance, the way we manage checkbooks is evolving. Digital solutions, such as mobile check deposit and electronic payments, are becoming increasingly popular. However, traditional checkbooks remain relevant for many users, particularly those who prefer tangible records of their transactions.

According to a report by the Federal Reserve, while the use of checks has declined over the years, they still account for a significant portion of non-cash payments in the United States. This trend highlights the importance of maintaining secure and efficient checkbook management practices.

Conclusion

In conclusion, ordering a checkbook from Chase is a simple and secure way to manage your financial transactions. By understanding the benefits, costs, and security features associated with Chase checkbooks, you can make informed decisions about your financial management. We encourage you to take action by ordering your checkbook today and exploring other financial tools offered by Chase.

Feel free to leave a comment or question below, and don't forget to share this article with others who may find it helpful. For more insights into personal finance and banking, explore our other articles on the site.

References:

- Federal Reserve: The Federal Reserve Payments Study

- Chase Bank: Official Website

- Consumer Financial Protection Bureau: Check Fraud Prevention Tips